Our Services

Investor Relations(IR)&Public Relations(PR)

The company is dedicated to enhancing corporate visibility, increasing stock liquidity and trading volume through comprehensive IR and PR strategies. Our team is experienced and well-versed in investor psychology, with a global perspective. We excel in utilizing social media channels popular among investors and leveraging financial key opinion leaders (KOLs). Additionally, we are endorsed by globally recognized authoritative financial institutions, ensuring effective communication between companies and investors and high brand exposure for enterprises.

Initial Public Offering (IPO) Advisory Services

In the realm of IPO consulting, we provide end-to-end services, including top-level design, financial and equity structuring, to support companies in successfully entering international capital markets.

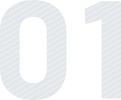

- CaseKoss CorporationKOSS

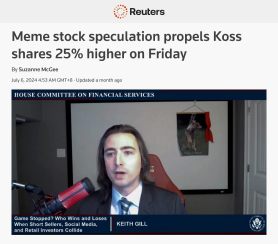

We established a 5-month collaboration with Koss Electronics on March 16th. During our sustained efforts over 5 months, trading volume surged to 1250 times its original average (approximately 16,000 shares/day in March — peaking at nearly 20 million shares in a single day in July), accompanied by a stock price increase exceeding 150%.(Figure 1-1: KOSS Candlestick chart with trading volume)We strategically identified precise, traffic-generating tags for the stock based on its characteristics, driving sustained interest and visibility. Leveraging highly active international social media platforms frequented by investors, we strategically promoted content to amplify Gauss Electronics' stock, collaborating with prominent financial influencers to enhance visibility. This resulted in a four-month surge in social media exposure, exceeding 3 million impressions daily, attracting significant investor attention and trading activity. Additionally, major global financial media outlets and investor relations platforms featured and disseminated our content, significantly enhancing the company's market recognition and trading volume. (Figure 1-2)What we did?

We established a 5-month collaboration with Koss Electronics on March 16th. During our sustained efforts over 5 months, trading volume surged to 1250 times its original average (approximately 16,000 shares/day in March — peaking at nearly 20 million shares in a single day in July), accompanied by a stock price increase exceeding 150%.(Figure 1-1: KOSS Candlestick chart with trading volume)We strategically identified precise, traffic-generating tags for the stock based on its characteristics, driving sustained interest and visibility. Leveraging highly active international social media platforms frequented by investors, we strategically promoted content to amplify Gauss Electronics' stock, collaborating with prominent financial influencers to enhance visibility. This resulted in a four-month surge in social media exposure, exceeding 3 million impressions daily, attracting significant investor attention and trading activity. Additionally, major global financial media outlets and investor relations platforms featured and disseminated our content, significantly enhancing the company's market recognition and trading volume. (Figure 1-2)What we did? Figure 1-1

Figure 1-1 Figure 1-2

Figure 1-2 - CaseRiot Platforms IncRIOT

Riot Blockchain, a Bitcoin mining and digital infrastructure firm, approached us on June 1, 2022, seeking to enhance their stock's visibility and activity. Over the course of our 10-month collaboration, RIOT's trading volume doubled from an average of 13 million shares daily to approximately 26 million shares, and its stock price doubled at one point. (Figure 2-1)We focused on comprehensive promotion and marketing across key international social media platforms such as YouTube, Reddit, Twitter, Discord, Telegram, and TikTok, integrating the trending concepts of NFTs and Web3.0. This was supplemented by leveraging our network with major global financial media, resulting in a significant increase in RIOT Blockchain's social media exposure, exceeding 5 million impressions daily over the 10-month period. This propelled RIOT to become one of the most sought-after stocks in the digital currency sector.What we did?

Riot Blockchain, a Bitcoin mining and digital infrastructure firm, approached us on June 1, 2022, seeking to enhance their stock's visibility and activity. Over the course of our 10-month collaboration, RIOT's trading volume doubled from an average of 13 million shares daily to approximately 26 million shares, and its stock price doubled at one point. (Figure 2-1)We focused on comprehensive promotion and marketing across key international social media platforms such as YouTube, Reddit, Twitter, Discord, Telegram, and TikTok, integrating the trending concepts of NFTs and Web3.0. This was supplemented by leveraging our network with major global financial media, resulting in a significant increase in RIOT Blockchain's social media exposure, exceeding 5 million impressions daily over the 10-month period. This propelled RIOT to become one of the most sought-after stocks in the digital currency sector.What we did? Figure 2-1

Figure 2-1 - CaseKimbell Royalty Partners LPKRP

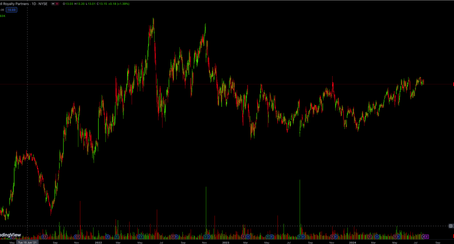

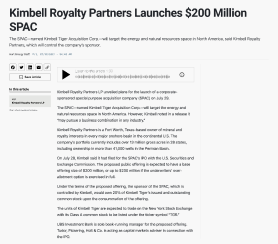

In June 2021, Kimbell Royalty, a Texas-based oil and natural gas company, partnered with us. Over the following six months, we executed a multi-channel, comprehensive promotional strategy aimed at increasing the company's visibility and trading activity. By November of the same year, daily trading volume had risen to approximately 470,000 shares, tripling from 150,000 shares in June, with a peak of 2.7 million shares traded on November 10th, nearly 20 times the June average.(Figure 3-1)Leveraging favorable information from the company's mergers and acquisitions, combined with analyst-target price increases, we initiated a targeted promotional campaign through our expertise in social media channels and collaboration with influential financial bloggers. This resulted in extensive exposure within investor communities and financial media, positioning Kimbell Royalty as a benchmark in the oil and gas sector and attracting significant investment interest. To date, the stock remains highly active, maintaining trading volumes around 500,000 shares. These cases illustrate our strategic approach to enhancing market visibility and investor engagement, leveraging a blend of targeted digital strategies and influential partnerships within the financial community. (Figure 3-2)What we did?

In June 2021, Kimbell Royalty, a Texas-based oil and natural gas company, partnered with us. Over the following six months, we executed a multi-channel, comprehensive promotional strategy aimed at increasing the company's visibility and trading activity. By November of the same year, daily trading volume had risen to approximately 470,000 shares, tripling from 150,000 shares in June, with a peak of 2.7 million shares traded on November 10th, nearly 20 times the June average.(Figure 3-1)Leveraging favorable information from the company's mergers and acquisitions, combined with analyst-target price increases, we initiated a targeted promotional campaign through our expertise in social media channels and collaboration with influential financial bloggers. This resulted in extensive exposure within investor communities and financial media, positioning Kimbell Royalty as a benchmark in the oil and gas sector and attracting significant investment interest. To date, the stock remains highly active, maintaining trading volumes around 500,000 shares. These cases illustrate our strategic approach to enhancing market visibility and investor engagement, leveraging a blend of targeted digital strategies and influential partnerships within the financial community. (Figure 3-2)What we did? Figure 3-1

Figure 3-1 Figure 3-2

Figure 3-2